Mortgage Banking

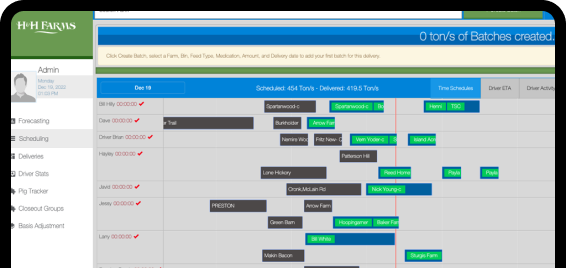

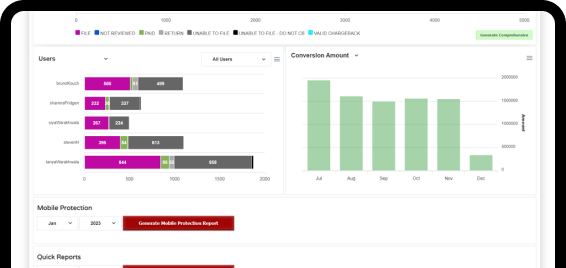

Our customer in the Mortgage Banking industry utilizes 15+ software platforms in all to simplify and optimize the lending process. Annual subscriptions for these services top $1 million, and they still have gaps which do not meet all of their needs. We analyzed the platforms and business processes to determine how we could reduce expenses and provide a better all-around solution.

Loan Officers

Licensed States

Loan Products Offered

%

Annual Company Growth

Challenge

Upon review there were a few platforms in which we could easily replicate the functionality of the platform and provide significant ROI. Once we began the planning phase of the project the customer also had interest in improving / creating several integrations which did not exist as well as additional functionality. Different teams within the organization had different views on what was the most important and where we should begin.

Solution

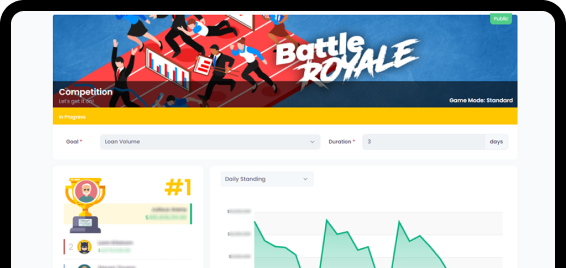

We chose to focus our efforts first on a platform which would not only provide significant long-term cost savings but also improve revenue. The platforms simplifies the process of creating and presenting multiple loan scenarios for clients. The current previous system the client utilized was too complicated and therefore only a handful of loan officers were using it. The user presentation was also a bit outdated, not provided the best experience for clients.

Result

Every data field, calculation, and process flow was reimagined reducing the time it took for a loan officer to create a client presentation by 50%. Due to the simplicity of the new system, loan office use skyrocketed and training cost was significantly reduced. Clients now receive a custom branded presentation, improving client / loan officer interaction and therefore closing more loans.

Tools used in this project

Other cases