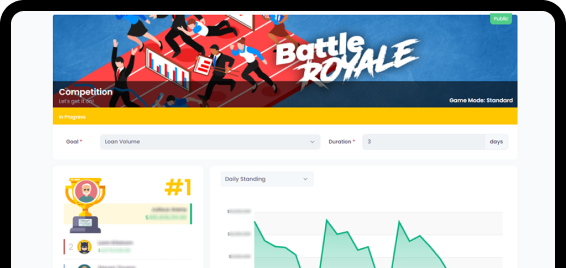

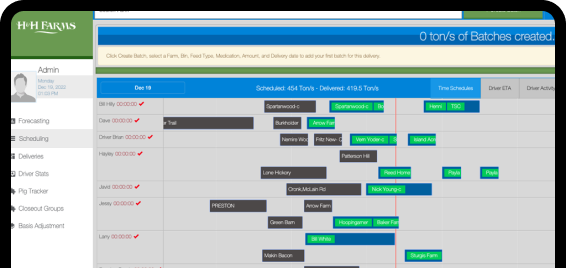

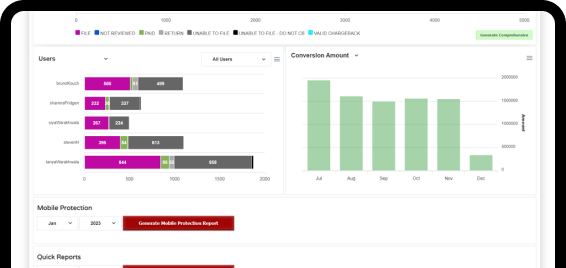

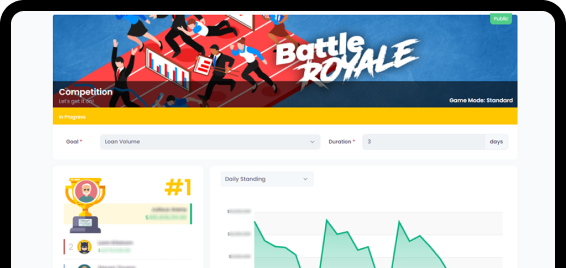

Explore our projects

We have successfully helped clients launch projects at various stages, from product idea validation and MVP implementation to scaling, further development, and support.

We have successfully helped clients launch projects at various stages, from product idea validation and MVP implementation to scaling, further development, and support.